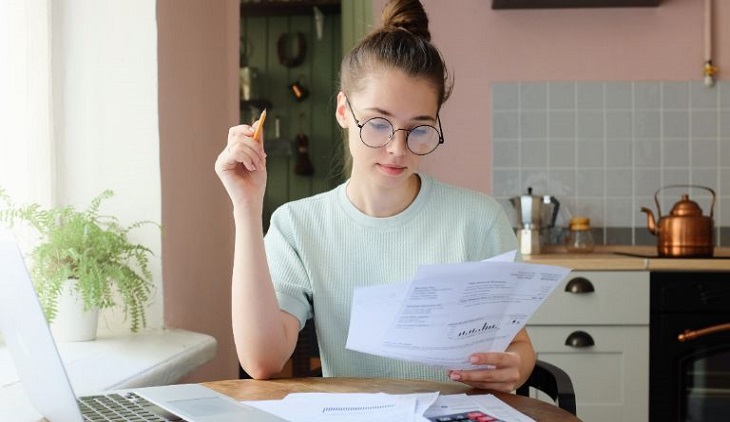

You can look through the following: Information about a career in accounting there are many possible jobs you might consider. A career as a tax professional is an excellent choice if you love working with taxes to maximize your refunds or reduce the amount that they owe. Tax accountant, you may be the right fit. Before making this decision, you should review the following information about your accounting career:

- tax accounting salary

- Education requirements

- duties performed

- Career advancement is common

Description of a Tax Accountant Job

Tax accountants are responsible for the preparation, analysis, and presentation of tax returns. They specialize in local, state, and federal taxes. Many tax accountants work for large corporations to ensure compliance with tax laws, and accurate returns are filed at the end of each year. You can also work for yourself to help clients prepare their tax returns.

- H&R Block

- Liberty Tax Service

- Jackson Hewitt Tax Service

Tax accountants can be more than just several people. They must also be able to communicate abstract concepts with clients. To be a successful tax accountant, you must have the ability to create tax strategies that will benefit your client. You will also need to have the following skills to succeed in tax accounting:

- High ethical standards

- Working knowledge of the federal income tax laws

- Research is my passion

Although we tend to think of accountants primarily as people, a good accountant does more than calculate the numbers. An accountant who is good at communicating the meaning of numbers to us will be a great one. Co-founder of American Institute for Certified Tax Coaches, Ed Lyon.

The Tax Accounting Education Overview

If you’re thinking of a career in education, there are many options. A career in tax accounting. Employers require that tax accountants have at least a bachelor degree in accounting Or a related field. A master’s degree in accounting can lead to a specialization in tax preparation and auditing. A designation as an accountant may be an option. Certified Public Accountant(CPA). This level will allow you to study more financial topics. You will learn how to prepare financial statements, capital management and cost-benefit analysis.

You may also consider a certificate program to prepare you for entry-level tax preparation work. These programs can be found at many community colleges and universities. These courses are some of the ones you might expect to take at this level:

- Corporation taxes

- Payroll taxes.

- Capital gains.

- Retirees face tax issues

- How to interview taxpayers.

- How to determine your filing status and exemptions.

A bachelor’s degree in Estudio Contable Impositivo will prepare you to work as a supervisor or tax auditor sooner than if you only have a certificate.

No matter which option you choose, tax accountants must become licensed CPAs. To remain under the supervision of the U.S Securities and Exchange Commission. You must register as a tax preparer with the federal government. You will receive a Preparer Tax Identification Number (PTIN) that must be used on all returns you help prepare on behalf of your clients.