Short Summary: Discover the diverse use cases implementing AML KYC compliance to safeguard businesses against illicit actions and enhance enterprises’ integrity.

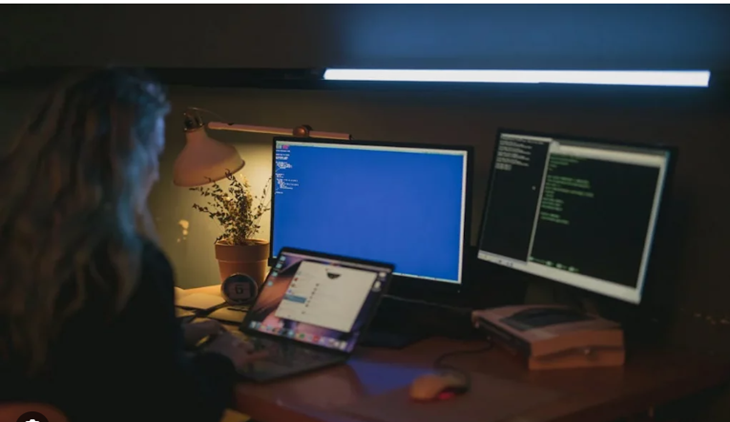

With the rapid adoption of artificial intelligence and the incorporation of pre-trained models. Online KYC solutions have become efficient and fast. These verification systems are implemented in different industries with diverse use cases. To know more about the online AML screening system, read the article and get quick insights into the AML regulations and how they are working effectively with KYC onboarding and sustaining the consumer’s experience.

Quick Understanding of Online AML KYC Solutions

Authenticating the consumer and adhering to anti-money laundering compliance are two primary components of the screening process in any industry. The companies are required to align their verification systems according to the AML obligations and relevant standards. For further information on the AML and KYC solution, go through the use cases of the anti-money laundering act below.

Use Cases for AML KYC Regulations

● Fraudster Verification

AML recognition systems have advanced solutions to deal with fraudsters and imposters to protect digital security. The AML compliance in the verification systems ensures the liveness detection, face search, face match, and cross-platform integrati

ons. Instant detection services can identify illicit transactions that can be used for terrorist funding. AML solutions can access global fraudulent actions and illegal money transactions by the imposter behind them.

The process works by capturing the images and collecting basic information that is required to verify the identity before they are onboarded or make any transaction. It is also used in account opening procedures where the chance of identity theft and account takeover is prone to financial criminals. However, the AML regulations implement enhanced suspicious activity reports, automating the verification methods

● Ensure CheckPoint Security

Sectors that are serving the government and related authorities need to comply with the AML practice to ensure security measures at the checkpoints. AML regulations can rapidly search worldwide and check the users against international bans and PEP watchlists. The AML KYC approach is an instant verification strategy that aims to assist the government agencies in protecting them against unauthorized access and money laundering cases.

Primary requirement of AML involves risk assessment and client due diligence along with having the facility of reporting the suspicious of the consumers if observed. The robust security systems that strictly adhere to the regulatory requirements are the ideal approaches needed to incorporate in the company to ensure that the businesses working under the government are secure and protected.

● Account Opening

One of the primary use cases of AML regulation is the account opening in the banking sector. The process of opening an account is prone to imposters, and they can easily mimic themselves and fool the management. However, the verification process of KYC checks verifies the authenticity of the users so that cannot launder black money or transact any illegal cost. These results secure the banks from losing the brand image, and the strong KYC approach ensures the AML obligation, which as a result protects the business against non-compliance penalties.

The strong AML systems develop policies that work according to the rules and regulations, eliminating the risk of fraudsters invading the bank’s financial department.

● Improved Surveillance

The AML process imporves the monetization of the business activities. This screening strategy works best with AML KYC compliance as the process of KYC involves knowing your consumer’s details and required information along with conducting a liveness test. Face recognition detection can instantly detect the transactions from individuals who are involved in money laundering cases.

The enhanced monetization is effective for the existing consumers and their dealing with the money and funding procedures. The AML screening works globally and can identify fraudulent transactions with the assistance of enhanced customer due diligence by assessing the risks. Companies are facilitated with improved suspicious activity reporting as well.

● Combat Identity Crime

Another important crime that the AML KYC compliance assists is identity theft, a threat to the sectors having financial departments. The automated structure incorporated by rich and pre-trained models and algorithms of artificial intelligence(AI) and neural networks (NN) are more efficient. These effective approaches ensure AML compliance, evolve constantly, and are now applicable to both financial and non-financial enterprises across the globe.

The check methods work best for harmful and negative news while keeping the organization secure. However, the political landscape is continuously filtering the real-time data while screening the AML-related rules to stay up to date.

Final Verdict

Abiding by the AML KYC regulations not only assists the business in dodging non-compliance penalties but also eliminates the risk of data breaches. Enterprises can delegate the KYC onboarding process to a specialized contributor who can develop the advanced Know Your Consumer methodology. It can lead the business to grow and improve its credibility.

Moreover, AML compliance can help user experience and fraud prevention while increasing business relationships in the digital landscape. The transaction screening and enhanced due diligence serve as a better inspection method in reducing the risk threats that can damage the brand’s image.